Groundwater Industry

Why valuations are at unprecedented levels & how your company can benefit.

Ascend/Eaton Square International M&A Advisor

Why M&A is Loving Groundwater Companies

The need for viable water resources is growing exponentially and the industry itself is highly fragmented. Companies in this sector are of an essential and indispensable nature.

The customers they serve are increasing and dependent on their services, creating significant recurring/re-occurring revenue models which are extremely attractive to buyers today. The growing demand for consolidation has caused a flurry of investment activity by the Best financial and strategic buyers actively seeking acquisitions for regional and national roll-ups.

These buyers have trillions in capital that needs to be invested and they are seeking ways to expand both organically and in-organically to meet their growth objectives.

For all these reasons, groundwater companies are one of the hottest targets in the M&A marketplace today creating positive shifts in how these businesses are being valued.

Exponential Growth

US & Global Water Sector

Because of aging infrastructure and growing demand for fresh water, business analysts are ramping up their focus on investment opportunities. In a study conducted in CDP’s Global Water Report 2022, over 1,100 CEOs located around the world are now reporting that their annual performance reviews are tied to the achievement of water goals.

Miriam Denis Le Seve, senior manager, water at CDP, said:

“The private sector should be treating water as a precious and fragile resource. Company investments into valuing water will make a huge difference to tackling this crisis head-on. The right time to act on these opportunities is right now.”

Data shared in the August 2023 report from CDP, reveals water sector opportunities in new products and services which could be worth an astonishing $1.7 trillion. That focus is being reflected in deal transaction data in the US and globally. (Pitchbook 01/2020-10/2023)

Water Sector Transactions

Deals ($5mm-$250mm)

Companies

Investors

US

992

778

1480

Globally

2200+

1800+

3373

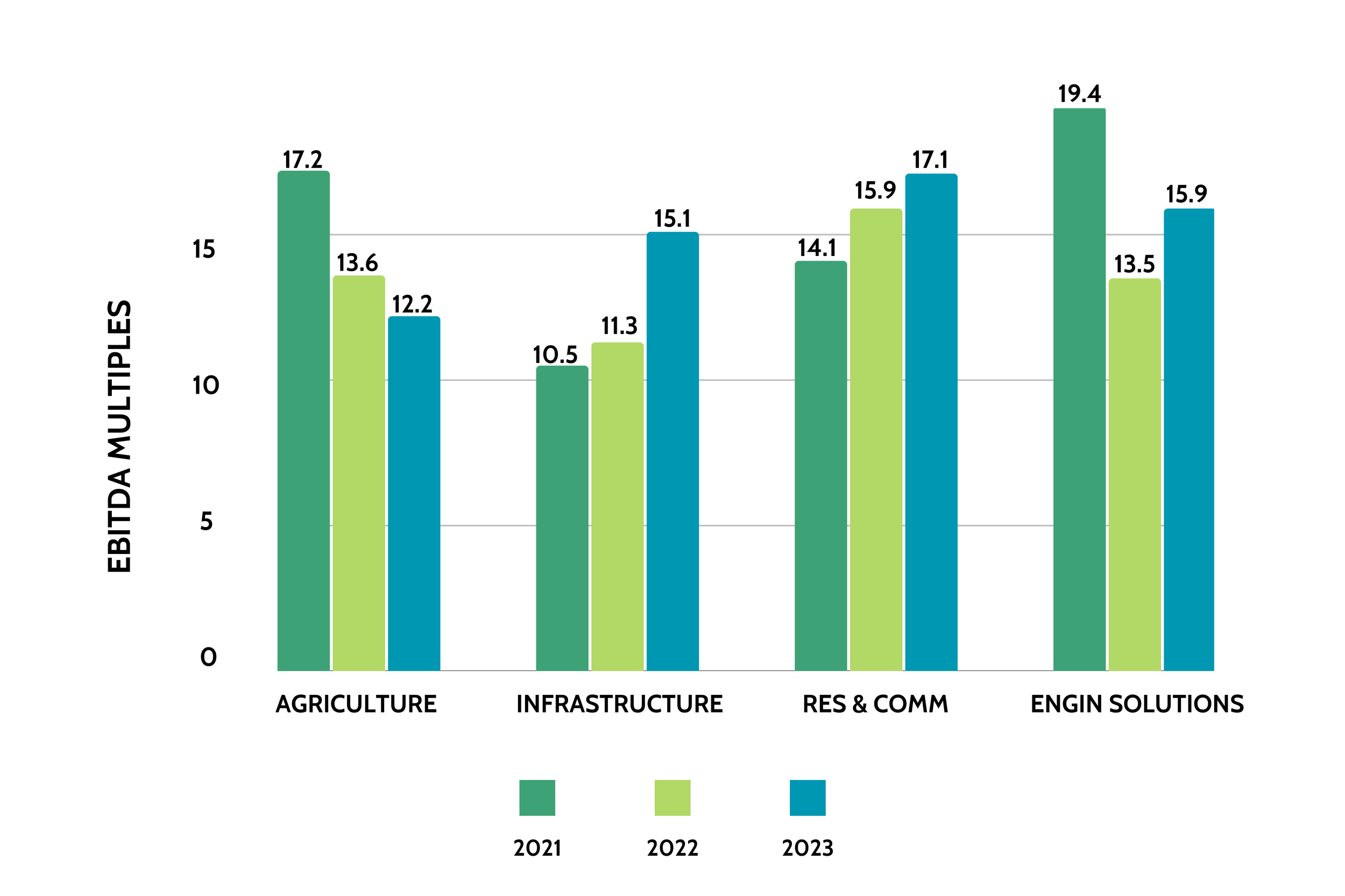

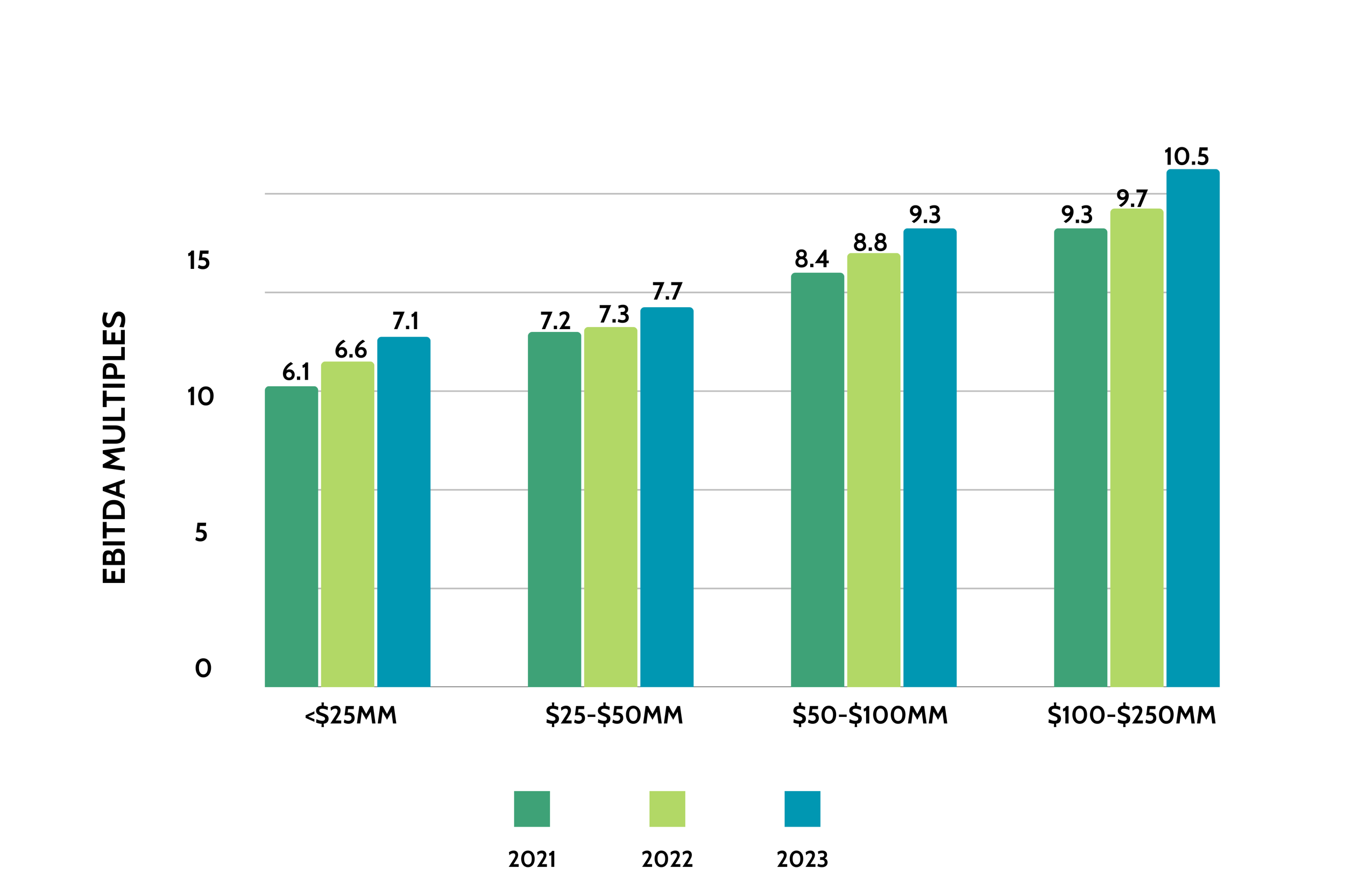

Water Sector Valuations

EBITDA Multiples

Public Company Valuation: EV/LTM EBITDA

Enterprise Value/EBITDA by Size

Publication: Raymond James – Water Quarterly, Summer 2023 Pumps and Systems - December 2022 Pitchbook – October 2022 McKinsey & Company – Water Infrastructure – June 2023

Key Value Drivers

-

Financial/Operational Performance: A company's historical and projected financial performance, revenue growth, profitability, cash flow generation, and return on investment play a crucial role in determining its value. Low operational risks, and a well-established operational infrastructure are also key value drivers. Buyers are more likely to pay a premium for companies with a solid track record of consistent performance.

-

Advantage: Companies with a strong market position, competitive advantage, and a differentiated value proposition are often more valuable. Market share, brand recognition and reputation, customer loyalty, unique intellectual property, and barriers to entry contribute to a company's competitive advantage.

-

A company's growth potential, both organic and inorganic is a significant value driver. Buyers are interested in companies that can demonstrate a capability for market penetration, new product development, geographic expansion, or access to new customer segments. Additionally, many buyers today are doing strategic roll-ups and are therefore interested in opportunities in fragmented markets where add-on acquisitions are available to promote growth.

-

The quality and size of a company's customer base can impact its value. A diversified and loyal customer base, long-term contracts, recurring/re-occurring revenue streams, and high customer retention rates are very attractive attributes.

-

Companies with valuable intellectual property, proprietary technologies, patents, or innovative products/services often command higher valuations.

-

The potential for cost savings and operational synergies resulting from the merger or acquisition can significantly impact the value of a company. Synergies can include economies of scale, shared resources, streamlined operations, or expanded distribution channels.

-

A strong and capable management team is a value driver. Buyers seek companies with experienced and talented leaders who can drive growth, execute strategies, and successfully integrate the acquired business.

-

A company's compliance with regulatory requirements, licenses, permits, and adherence to industry standards can affect its value. Companies with a strong regulatory track record and robust compliance processes are typically more attractive to buyers.

Ascend Valuation Effect

Optimizing Potential

The ability to unify businesses within a segment by employing a buy/build strategy creates a dominant industry force and therefore a highly valuable enterprise. These transactions are almost always accretive because of the synergies inherent in this approach. Therefore, acquisitions are being sought and roll-ups are occurring and the potential for higher valuations is greater than ever.

In an active market such as this, sellers can be enticed by many buyers offering high EBITDA multiples. However, in many instances, they apply them against a 3–4 year average EBITDA which in most cases significantly reduces the overall valuation. Ascend has been able to support an EBITDA that represents the go forward new normal for the company and bring the Right Buyers to the process (over 70 on our current water sector transaction) to obtain the optimum deal. This has equated to valuations for our clients 50%+ higher than original offers. This is just one example of how we increase value for our clients.

The opportunities for today’s groundwater companies are many. Having an M&A expert is essential to finding and negotiating the most advantageous deal possible. The momentum in this sector is seeing a plethora of possibilities that vary in accordance with the desires of the seller. This also includes potentially significant second bites-of- the-apple (being paid twice for your company).

Second-Bite Strategy

This can be very lucrative for business owners, allowing them to benefit from the future appreciation of the new business created by an M&A transaction. It refers to the act of selling ownership in your business in separate stages, which most likely occur several years apart. The first “bite” typically means selling only a controlling interest during the initial transaction.

The second “bite” is typically realized in a future sale and can be extremely rewarding.

-

During the first stage or initial sale of the company, a partnership is developed between the owner and a Private Equity Group (or similar entity) allowing the previous owner to “roll equity” becoming a minority partner. Typically, terms are agreed that keep ownership in place for a determined time but frees them from day-to-day tasks to engage operationally at a more profound level which, in turn, will enable the business to experience significant growth.

The second “bite” is typically seen a few years after the initial sale. This second sale is often as lucrative, if not more so, for the owners than the first sale because the new partnership has successfully executed a growth plan to make the business larger and more profitable. A percentage of that larger business can often be greater than the total sale of the original business. This can be a very desirable approach for buying and selling privately held businesses because it can minimize the risk for the buyer, and clearly defines a beneficial exit path for the owner.

There are a multitude of choices for business owners in the groundwater industry today and they all begin by setting your goals, exploring your valuation, and consulting with an M&A expert to fully realize your opportunities.

Don’t Go It Alone

How Ascend/Eaton Square Can Help

Founded in 2006, Ascend is a Middle Market Merger & Acquisition Sell-Side and Advisory firm. In 2022, we partnered with Eaton Square Advisors generating a vast global buyer and resource network. This allows us to provide an even greater depth of service to our clients.

The Ascend team has closed over one hundred transactions and participated in hundreds of financial and advisory engagements for companies with revenues from a few million to several hundred million. Our team is comprised of M&A advisors with expertise in the industrial, logistics, construction, healthcare, field services, technology, and other related sectors.

Unearthing value for every client we serve is our specialty, but it is in serving middle market businesses where our expertise really shines. It is these companies that often benefit most from our ability to uncover their ultimate value.

We excel in discovery and welcome intriguing challenges and opportunities to unleash each of our client’s fullest potential. We do this by focusing on Process, Positioning and Partnership, maintaining the strictest confidence, and taking the burden from your shoulders to ours.

The Alliance

Ascend & Eaton Square

Founded in 2008, Eaton Square is an international M&A and capital service firm. Together Ascend Strategic Partners and Eaton Square provide over 120 senior M&A and capital services professionals across the globe with over 30 offices in the US, Canada, UK, Spain, Andorra, Switzerland, Australia, New Zealand, Qatar, China & Hong Kong, Japan, Singapore, Italy, and Malaysia.

Ascend’s Partnership with Eaton Square provides extremely valuable assets for all our clients in several fundamental ways including:

Exposure to Buyers and Sellers Internationally

Greater Expertise in Key Verticals

Feet on the Ground Throughout the World

Superior access to all forms of Debt for our Buyers and Clients

Ascend & Eaton Square

Proven Experience

Mike Friar is Ascend’s Managing Member and a Principal of Eaton Square. Mike began his venture into the M&A arena where he worked for KPMG managing client acquisitions and due diligence processes for some of the largest clients in the world. Mike founded FHA CPA’s, Ascend’s predecessor in 1990, which by 2005 had 50 people and was one of the top accounting and M&A firms in the San Francisco Bay Area.

Based on his M&A experience, Mike identified an opportunity to establish a company with a sales process focused on optimizing valuations by understanding and leveraging each client’s unique and specific attributes and in 2006 founded Ascend Strategic Partners. Mike has been involved in over 100 M&A transactions along with hundreds of advisory engagements.

He has over 35 years of investment banker/business brokerage and professional CPA experience. His strategic business management experience along with his reputation for getting deals done and facilitating win-win scenarios is the cornerstone of his practice.

Financial vs Strategic Buyers

Strategic buyers are companies (both Private and Public) who tend to be in/or related to your industry and often acquire 100% of the business. Strategics need acquisitions to continue to grow and expand their service offerings and have trillions on their balance sheet to accomplish this.

Financial buyers, who are the number one acquirer of businesses under $250 million in value, are made up of private equity groups (PEG’s) and family offices. Currently, there are estimated to be over 7,000 financial buyers in the US alone. They usually wish to purchase a controlling interest in the company (51%-100%) with the mission of rapidly growing the business and then selling 3-7 years in the future.

This opportunity could allow you to take a second bite of the apple by selling your retained ownership on the second sale, which can be significantly more than the original one in terms of monetary payment.

Maximizing Your Value

Tailored Solutions

Because selling a company is one of the most critical decisions for any business owner, we structure each sales process to meet our clients’ specific goals and maximize the value of our clients’ companies by:

Proactively preparing the company for a successful sales process

Optimally positioning the company’s value proposition and financial information including maximizing add-backs (both obvious and hidden)

Effectively and professionally managing the process

Creating a “competitive” bidding environment

Bringing the “Right” buyers to the process and identifying the ones who love and need you the most

Anticipating, and effectively responding to buyer’s concerns

Aggressively negotiating deal terms

Maintaining deal momentum throughout the process

In summary, the M&A valuation is a unique combination of art and science. The client creates the science with the wonderful company they’ve built.

The right M&A professional elevates that science to its highest potential by designing the best, custom-tailored process to achieve each client’s individual goals.

The Ascend Process

M&A Transactions

The sophistication of today’s buyers has created multi-faceted transaction structures which require the involvement of a host of experts…accountants, lawyers, tax professionals and M&A specialists. We have completed hundreds of deals over the last 30+ years because of our ability to navigate, negotiate and elevate the level of every transaction.

More than ever, you need an M&A expert on Your Team who understands today’s deal strategies to obtain the Sales Price and Deal Terms you deserve.

Download the PDF below to learn more about our process and how Ascend & Eaton Square can help you.

Featured Case Studies

EcoInteractive

Golden State Assembly

Credit Report.com

Stonehouse Drilling

Pumpman

Intellekt Group

Exym

Stonehouse Drilling

“Mike, we cannot thank you enough for your expertise, patience, candor, amazing personality, professionalism, and I could go on and on. Please feel free to use me as a reference for any future transactions. I would love to sing your praises!!!”

“The value, structure and ownership’s responsibility post-transaction could not have been more perfect. It was the deal we imagined when we began the process.”

~Bret and Stephanie Tompkins

-

Stonehouse Drilling is a water well drilling and pump company that specializes in municipal, agricultural, mining, and industrial water wells and pump systems across California, Nevada, and Oregon. Stonehouse specializes in large-scale municipal projects including large diameter municipal water well drilling and multi-well projects. The focus of this transaction was to identify the best buyer to facilitate our client’s goals and objectives in addition to obtaining a strong value and advantageous deal terms.

Our client became the platform for the buyer, which along with the size and complexity of this deal, necessitated coordinating over 60 business professionals on both the buyer’s and seller’s team. This included legal, financial, operational, accounting, tax, and insurance professionals to orchestrate the asking and answering of questions and dealing with all the issues that come up along the way. Ascend’s 30+ years of transaction experience and vast CPA background allowed us to anticipate, collaborate, mitigate and coordinate with all these specialists to achieve our client’s expectations.

Pumpman

“We were amazed and delighted Ascend was able to find us that “right buyer” who was willing to pay so much more than what consistently seemed to be the top pricing in the market.”

~Eric Skjarstad

-

PumpMan is a leading provider of ONSITE maintenance, repair and replacement of pumps, motors, controls, valves, water wells and other equipment used in the water and wastewater systems of industry, offices, multi-family residential and municipalities and is serving locations throughout the US. We sold this company to an East Coast Private Equity Group, who entered our process late in the game, but paid a premium over what appeared to be top of the market pricing.

The final price on which the deal was closed was 20% higher than any of the other prospective buyers. The reason for the premium was because we were able to locate this preeminent buyer who was backed with over $300 million and who wanted to execute a strategic roll-up in this industrial water sector. This happened because we NEVER stop marketing throughout the entire process.

This process took approximately one year from engagement to completion. We helped the company prepare and then positioned, marketed and assisted in compiling and/or reviewing all necessary documentation. Our ability to guide our seller from inception to closing facilitated a deal that closed significantly above the originally anticipated price.

Intellekt Group

“Mike, thanks again for everything throughout this endeavor! No way in heck that I could have done what we’ve done and increased the overall value without you.”

~ Troy Glenn

-

70 days from hire, 45 days from entering LOI, this sale of a Texas based Government Services company closed. The company was primarily involved in intelligence, IT and education in various service sectors of the state and federal government. Engaged initially to negotiate with a prospect who had already approached our client, we initiated an accelerated process to invite several other prospects to the table with competitive bids. We used these bids to negotiate with the original prospective buyer, raising the purchase price by over 25% and adding some advantageous deal terms, including getting the deal finalized before year end. We entered LOI November 15, contracts were signed on December 30th and the funds were sent out via wire transfers on the 31st.

Exym

“I can’t believe Ascend obtained a valuation almost double of what I did on my own!”

~Matt DeBeer

-

Exym is a Healthcare technology company based in Southern California. We sold to a Private Equity Group for approximately 10 times EBITDA. The client had previously gone to market independently and after being unsuccessful, engaged Ascend as their M&A Firm. We repositioned our client and reached out to a more complimentary group of well vetted, prospective buyers. Upon the restructuring of our client’s process, we were able to find that “right buyer” and obtain a valuation that exceeded our seller’s original attempts by over 50%.

EcoInteractive

“Ascend told me what I’d get as a valuation and that is why I decided to sell. They did exactly what they said and closed more quickly than I even imagined.”

~Michael Legg

-

EcoInteractive , a Governmental transportation technology (SaaS) company based in Davis, Ca., was sold to a large private equity group for approximately 10 times EBITDA. We structured a deal with this buyer to maximize value for our client along with allowing ownership to leave within one-year post-transaction. Ascend managed the due diligence (financial, operations, and technology), attended regular meetings in addition to having almost daily client/buyer phone calls, which together allowed this transaction to close in approximately 75 days from LOI.

Golden State Assembly

“This was a long and complicated process. I really believe that Ascend is the only firm that could have brought us across the finish line.”

~Cesar Madrueno

-

Based in Silicon Valley, GSA is a tier-one manufacturer in the e-vehicle, aerospace, communications, and technology sectors, working with some of the top companies in the world. The focus of this transaction was not only to obtain the highest valuation, but also to identify the best partner to facilitate exponential growth. Ascend succeeded in finding the right partner to complete a deal that brought in a very high up-front valuation and allowed our client to retain 45% of the new company going forward.

This transaction was extremely complex and took over two years from engagement to completion. This was primarily due to the financial systems component. The company had grown so quickly from several million in revenue to over a hundred million and this segment of the company's operations had not kept up. This transaction could never have made it through due diligence by the buyer and financial institutions without Ascend’s comprehensive CPA experience and expertise.

CreditReport.com

“I still can’t believe we received the price we did. I would have been happy with $150mm-$175mm, but $220mm was beyond my wildest dreams.”

~Sheldon Kasower

-

Ascend sold Mighty Net (parent of Credit Report.com) a credit monitoring, ecommerce, and financial services company based in Calabasas, Ca. to Experian for over $220 million. The company originally signed with a large investment banking firm. The top offer they received was $125 million. The owner was not satisfied and ended up engaging Ascend. Because of certain governmental regulation changes and strategic needs Ascend identified Experian as a top prospect. Originally, our client did not believe they were a good fit. We conveyed our reasons for wanting to reach out and eventually they allowed us to do so. We worked with our client to create a business plan and the projections, along with increasing the EBITDA from $10 million to $18 million by identifying a significant number of unique and previously unidentified add-backs. These add-backs withstood the scrutiny of Ernst & Young, a Big Four accounting firm retained by the buyer. Included in the sales price was a $13.5 million working capital deficit assumed by Experian that Ascend negotiated. We knew it could be an issue later in the process, therefore, we worked with the seller’s legal counsel to ensure it was bulletproof in the LOI. Experian did challenge it, but Asend’s LOI language prevailed.

How Can We Help?

WEALTH IS THE ABILITY TO FULLY EXPERIENCE LIFE”

-Henry David Thoreau